Business loans are becoming more and more popular, as they offer a great way to finance a company. In fact, according to Fundera, the number of small firms that seek funding to either grow their operations, capitalize on opportunities, or buy company assets is estimated to be 56%. However, before taking out a loan, it is crucial to understand the different reasons why people take out business loans. This article will explain seven of the most common reasons to get a business loan.

1. To Start a Business

Image Credit : Google

There are several reasons to get a business loan, but one of the most common is to start a new business. This can be an exciting time, but it can also be overwhelming, especially if you’re unsure where to start. Here are some tips to help you get started.

First, do your research. Make sure you have a solid business plan and know what you’re getting into. It’s also important to know your target market and how you will reach them.

Second, make sure you have the right team in place. You’ll need a good accountant and lawyer to help you with the paperwork and financials, and you’ll need someone who can help with marketing and sales.

Finally, be prepared to put in the hard work. It takes a lot of time and energy to start a business, but it can be worth it in the end. Just make sure you set realistic goals and stay focused on your ultimate goal. However, if you’re still unsure whether getting a business loan is the right option for you, ensure you reach out to financial experts. They can help you weigh your options and decide what’s best for your business.

2. To Expand a Business

Image Credit : Google

Expanding a business is another common reason to get a business loan. Whether you’re looking to open a new location or add to your existing space, a loan can provide the financing you need to make your expansion plans a reality.

There are many different types of loans available for business expansion, so it’s essential to do your research and choose the option that makes the most sense for your company. SBA-backed loans are often a good choice for small businesses, as they offer competitive rates and flexible repayment terms.

3. To Buy Equipment or Inventory

Image Credit : Google

When it comes to business loans, another common reason that companies take out loans is to buy equipment or inventory. This can be anything from office furniture and computers to manufacturing equipment and inventory for a retail store.

There are a few different ways this type of loan can be structured. The first is called an asset-based loan. This type of loan is secured by the equipment or inventory that is being purchased. The lender will hold onto the asset’s title until the loan is paid off in full.

Another option is called accounts receivable loan. This type of loan is based on a company’s outstanding invoices. The lender will give the company a percentage of the face value of the invoices. This percentage is usually around 85%. The company will then have to pay back the loan plus interest as the invoices are paid.

When taking out a business loan for equipment or inventory, keep two things in mind. The first is to make sure that you can afford the monthly payments. The second is to ensure that the equipment or inventory is worth the loan amount. You don’t want to end up taking out a loan for something that ends up being worth only half of what you borrowed.

4. To Pay Off Debt

Image Credit : Google

Debt is one of the most common reasons people take out business loans. There are a few different ways to use a loan to pay off debt. The first is to consolidate your debts into one monthly payment. This can help you save money on interest and make it easier to keep track of your payments.

Another way to use a loan to pay off debt is to get a cash advance on your credit cards. It can be a good option if you have high-interest rates on your credit cards and need extra cash to help you make your payments. You can also use a loan to pay off the debt by taking out a home equity loan. This can be a good option if you have equity in your home and need extra cash to pay off debts.

Finally, you can use a business loan to pay off the debt by refinancing your mortgage. This can be a good option if you have a high-interest rate on your mortgage and want to lower your monthly payments.

No matter what method you choose to use a business loan to pay off debt, you must shop around for the best rates and terms. You should also make sure that you understand all of the fees associated with the loan before you sign any paperwork.

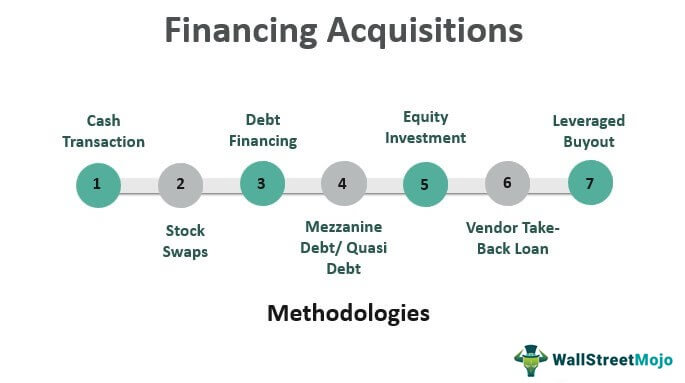

5. To Finance a Business Acquisition

Image Credit : Google

Acquiring a business is another common reason that small businesses take out loans. There are many different business acquisitions, but they all typically involve purchasing another company’s assets or equity.

A few different ways exist to finance a business acquisition. The most common is to use debt financing, which involves taking out a loan to cover the purchase cost. Equity financing is another option, which involves selling shares in the acquired company to raise funds.

Business acquisitions can be complex transactions, and it’s essential to work with an experienced loan officer to get the best possible terms for your loan. Small Business Administration (SBA) loans are often used to finance business acquisitions, and they typically offer more favorable terms than traditional bank loans.

6. To Fund a Marketing Campaign

Image Credit : Google

Marketing is essential for any business, but it can be expensive, and it’s often difficult to find the money to pay for it. There are several different ways to market your business, and each has its own set of costs. Common methods include advertising, PR, social media marketing, and search engine optimization. The cost of each of these activities varies depending on how you choose to implement them, but they can add up quickly. A business loan can help you pay for all or part of your marketing budget, giving you the resources you need to succeed.

7. To Cover Unexpected Expenses

Image Credit : Google

Another common reason to get a business loan is to cover unexpected expenses. Whether it’s an unexpected bill or an emergency expense, having funds available can help keep your business running smoothly.

There are a few things to consider when considering a business loan for unexpected expenses. First, be sure to estimate how much you will need and compare that to the amount you can afford to repay. Also, be sure to research different lenders and compare interest rates.

Finally, be aware that taking out a loan for unexpected expenses may affect your credit score. If you’re not able to repay the loan on time, it could damage your credit score and make it more challenging to borrow money in the future. However, if you can responsibly manage a business loan for unexpected expenses, it can be a helpful tool to keep your business running smoothly.

There are many reasons to get a business loan. Whether you need to expand your operations, cover unexpected costs, or need some extra cash to keep your business afloat, a loan can be a great option. Keep in mind, though, that you should always research your options and compare interest rates before you decide on a lender. And be sure to read the fine print to know what you agree to.

If you are considering taking out a business loan, be sure to contact Capital Bank today. We offer a variety of loan products. Our experienced team can help you find the best loan for your needs and guide you through the process. Reach out today to learn more about our financing options.

Read also : 7 Best Finance Blogs and Their Best Content

Read also : 6 Best Small Business Loans